This does not always happen, however, often depending on the underlying fundamentals of the business.

If that increased demand causes the share price to appreciate, then the total market capitalization rises post-split. Often, however, a lower priced stock on a per-share basis can attract a wider range of buyers. When a company such as NVIDIA splits its shares, the market capitalization before and after the split takes place remains stable, meaning the shareholder now owns more shares but each are valued at a lower price per share. For example, a 12000 share position pre-split, became a 48000 share position following the split. This was a 4 for 1 split, meaning for each share of NVDA owned pre-split, the shareholder now owned 4 shares. NVDA's 5th split took place on July 20, 2021. For example, a 8000 share position pre-split, became a 12000 share position following the split. This was a 3 for 2 split, meaning for each 2 shares of NVDA owned pre-split, the shareholder now owned 3 shares. NVDA's 4th split took place on September 11, 2007. For example, a 4000 share position pre-split, became a 8000 share position following the split. This was a 2 for 1 split, meaning for each share of NVDA owned pre-split, the shareholder now owned 2 shares. NVDA's third split took place on April 07, 2006. For example, a 2000 share position pre-split, became a 4000 share position following the split. NVDA's second split took place on September 17, 2001. For example, a 1000 share position pre-split, became a 2000 share position following the split. Split, meaning for each share of NVDA owned pre-split, the shareholder now owned 2 shares. The first split for NVDA took place on June 27, 2000.

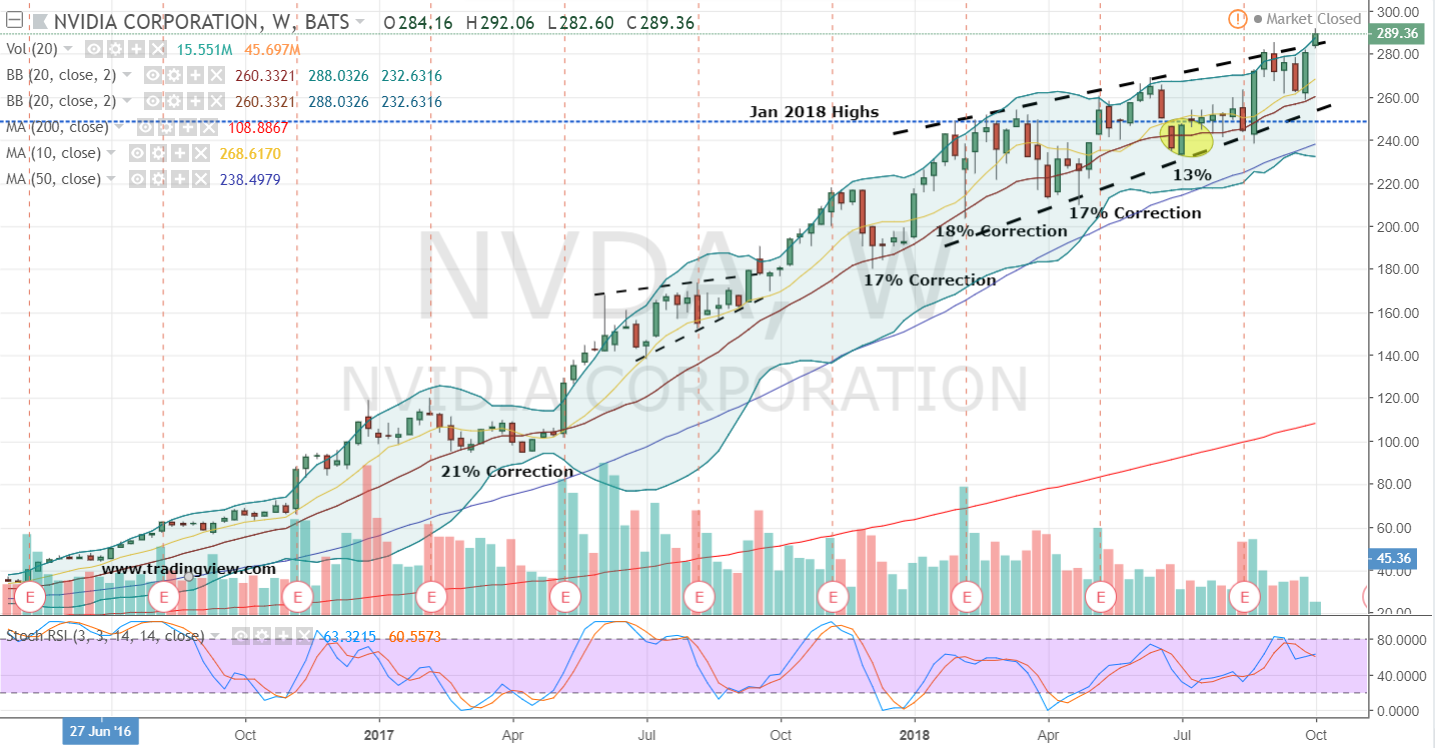

/images/2021/07/02/nvidia-stock.jpeg)

NVIDIA (NVDA) has 5 splits in our NVIDIA stock split history database.

0 kommentar(er)

0 kommentar(er)